Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries from July 1, 2019 - July 31, 2019

Business Aviation Trends

Wednesday, July 24, 2019 at 7:51PM

Wednesday, July 24, 2019 at 7:51PM

All of the aircraft included in the aircraft segment graphs on the following pages have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Market Conditions and Inventory

Wednesday, July 24, 2019 at 7:40PM

Wednesday, July 24, 2019 at 7:40PM By Dennis Rousseau | President and Founder | AircraftPost

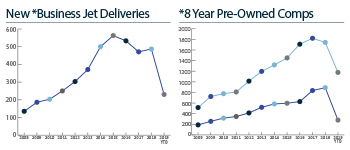

Over the last couple months, we’ve heard many perspectives, and in some cases hyperbole, on market conditions and inventory, most leaning in the direction of too few aircraft on the market and those that are available are too old, new, high priced, wrong equipment, color, etc. Before delving into this further, perhaps it’s prudent to mention that prior to an economic downturn, our markets do in fact act erratically. As of July 2019, the US economic expansion is now the longest on record, entering its 121st month since the end of the 2009 recession and surpassing the previous 120-month record that ended with the dot com bust. Conversely, the majority of financial indices are pointing in the direction of a global recession toward the end of this year and there are many countries currently feeling the contraction. China, Japan, Germany, UK, Taiwan, S Korea, Italy and Russia are some of the countries currently experiencing a downturn. Could this have an impact on business jet transactions? Absolutely.

In terms of new aircraft deliveries, the height of the market was in 2015 when 563 new business jets entered service, almost double the 203 delivered in 2010. Fast forward and new aircraft deliveries have waned, dropping 13% in just 3 years. In the first 6-months of 2019 we’ve seen 230 new business jet deliveries and even IF sales and production continued on track for the year...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Market Conditions,

Market Conditions,  aircraft inventory,

aircraft inventory,  deliveries,

deliveries,  economy

economy FAA Certifies Gulfstream G600

Wednesday, July 24, 2019 at 7:26PM

Wednesday, July 24, 2019 at 7:26PM | Business & Commercial Aviation

In late June, Gulfstream’s G600 received its type and production certificates from the FAA, clearing the way for first deliveries to begin this year. “Getting both authorizations on the same day is evidence of the maturity of our G600 production processes and speaks to the safety and reliability of the aircraft’s design,” said Gulfstream President Mark Burns, who went on to note that the FAA award came less than a year after similar dual certifications were bestowed simultaneously upon the all-new G500. The G600 performance specifications include a 6,500-nm range at Mach 0.85 cruise, or 5,500 nm at Mach 0.90. The new model features a Symmetry Flight Deck, including active control sidesticks and 10 touchscreens. The aircraft can be configured with three living areas in the passenger cabin, plus a crew rest area forward.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  FAA Certification,

FAA Certification,  Gulfstream G600 in

Gulfstream G600 in  BCA

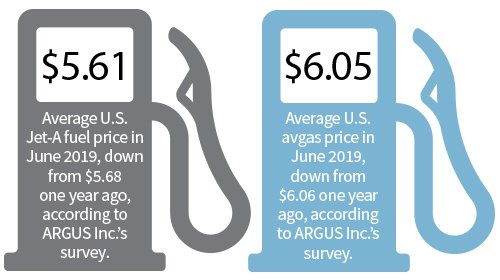

BCA Situational Awareness

Wednesday, July 24, 2019 at 7:17PM

Wednesday, July 24, 2019 at 7:17PM From The Weekly of Business Aviation, Aviation Week Intelligence Network / awin.aviationweek.com

Used Bizjets for Sale Up 2% in June

The number of used business jets for sale rose 2% in June to 1,772 aircraft, which represents 7.6% of the active fleet, according to a report by Jefferies.

Inventories of heavy jets rose 3% year-over-year, while medium jet inventories declined 2%.

The number of newer aircraft on the market represents 5.8% of the used fleet, “which may be a relatively low level as we have been hovering at this rate for a year or so,” Jefferies said. “We now expect new deliveries to grow by 8% in 2019 after a modest decline in 2018.”

The inventory levels of used Dassault jets on the market declined 2% in June compared to a year ago, with 57 aircraft for sale. Pricing rose 6%, driven by the Falcon 2000 series.

Gulfstream inventories rose 6% from a year ago with 89 aircraft for sale, up from 84 a year ago. Pricing declined an average of 13% from a year ago.

The number of Cessna business jets for sale rose 13% from a year ago with 213 aircraft for sale, representing 5.9% of the active fleet. Average list prices rose 3% from...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Cessna Citation Sovereign 680 - Aircraft Bluebook At-a-Glance

Wednesday, July 24, 2019 at 6:59PM

Wednesday, July 24, 2019 at 6:59PM By Chris Reynolds, ASA | Editor/Aircraft Appraiser | Aircraft Bluebook

Aircraft Bluebook has reviewed the current market status of the Cessna Citation Sovereign 680 business jet for this At-a-Glance update. Research for this study was obtained in part from Aircraft Bluebook, Aircraft Bluebook’s Historical Value Reference, the FAA’s registry web site and various trade services.

Demand

Produced from 2004 through 2013*, about 98 percent of the Sovereign fleet is currently in service (approximately 345 aircraft) with the vast majority in the U.S. (of which NetJets has been the largest operator). At the time of this writing, approximately 15 - 20 Sovereign 680s, representing a little over four percent of the active fleet, were reported for sale. Average time on market is likely 150 days or longer; equipment, time/condition and...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |