Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries in Market Conditions (2)

Year in Review

Wednesday, November 13, 2019 at 1:24PM

Wednesday, November 13, 2019 at 1:24PM By Dennis Rousseau | AircraftPost

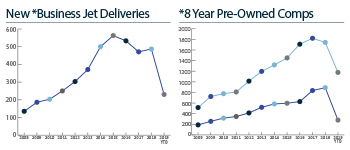

If we ask 3 different sources how the business jet sales are faring YTD 2019, I’ll guarantee 3 different answers. However, as our mantra has become ‘let the markets speak for themselves’, the numbers tell the story. New business jet deliveries have seen a YOY decrease showing 489 aircraft entering service in 2018 compared to 351 YTD 2019. As always, some fare better than others. By way of example, the Cessna Citation XLS+ shows 17 deliveries for 2018 and 15 YTD; Dassault Falcon 2000 LX shows 10 and 9, respectively and Gulfstream shows...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Market Conditions and Inventory

Wednesday, July 24, 2019 at 7:40PM

Wednesday, July 24, 2019 at 7:40PM By Dennis Rousseau | President and Founder | AircraftPost

Over the last couple months, we’ve heard many perspectives, and in some cases hyperbole, on market conditions and inventory, most leaning in the direction of too few aircraft on the market and those that are available are too old, new, high priced, wrong equipment, color, etc. Before delving into this further, perhaps it’s prudent to mention that prior to an economic downturn, our markets do in fact act erratically. As of July 2019, the US economic expansion is now the longest on record, entering its 121st month since the end of the 2009 recession and surpassing the previous 120-month record that ended with the dot com bust. Conversely, the majority of financial indices are pointing in the direction of a global recession toward the end of this year and there are many countries currently feeling the contraction. China, Japan, Germany, UK, Taiwan, S Korea, Italy and Russia are some of the countries currently experiencing a downturn. Could this have an impact on business jet transactions? Absolutely.

In terms of new aircraft deliveries, the height of the market was in 2015 when 563 new business jets entered service, almost double the 203 delivered in 2010. Fast forward and new aircraft deliveries have waned, dropping 13% in just 3 years. In the first 6-months of 2019 we’ve seen 230 new business jet deliveries and even IF sales and production continued on track for the year...

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |  Market Conditions,

Market Conditions,  aircraft inventory,

aircraft inventory,  deliveries,

deliveries,  economy

economy