Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Late-Model Jet Values Are Competitive

Thursday, June 23, 2016 at 3:45PM

Thursday, June 23, 2016 at 3:45PM Most Business Aircraft Values Are Stable

By Carl Janssens, ASA | Chief Appraiser | Aviation Week Network

As the days of summer have grown, so have available inventories of late-model business jets in the global market. What makes these days most interesting are the volumes of late-model jets for sale with competitive pricing. Is it merely an intensely divided election season, or is it a case of an unbalanced market with more inventories than buyers? It would be suggested that politics is not the justification for where the pre-owned market is today, though a negative perception of business aviation generated by media outlets in past years has not encouraged pre-owned aircraft sales either. So what about the market imbalance for late-model business jets? Dennis Rousseau, from AircraftPost, has made some interesting analogies on the subject. See his comments in the pages of Marketline.

As the days of summer have grown, so have available inventories of late-model business jets in the global market. What makes these days most interesting are the volumes of late-model jets for sale with competitive pricing. Is it merely an intensely divided election season, or is it a case of an unbalanced market with more inventories than buyers? It would be suggested that politics is not the justification for where the pre-owned market is today, though a negative perception of business aviation generated by media outlets in past years has not encouraged pre-owned aircraft sales either. So what about the market imbalance for late-model business jets? Dennis Rousseau, from AircraftPost, has made some interesting analogies on the subject. See his comments in the pages of Marketline.

Jet

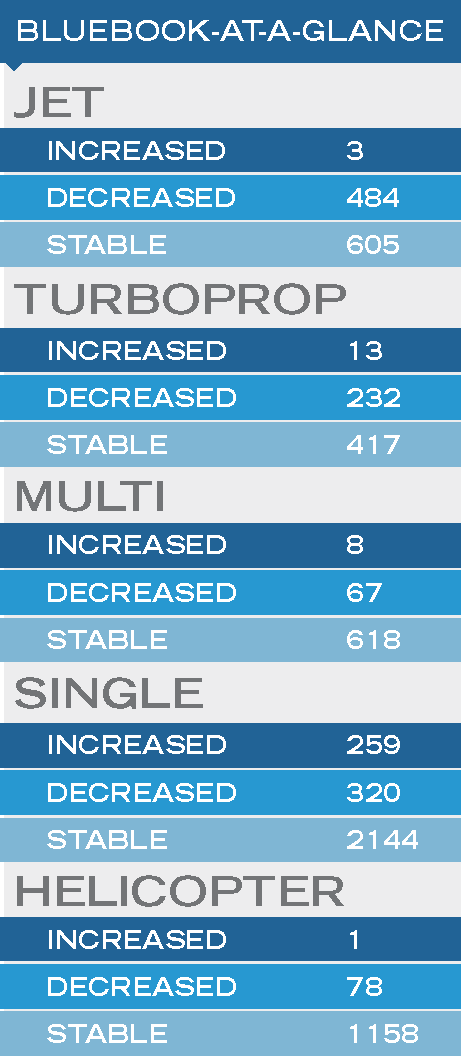

Among the Aircraft Bluebook aircraft categories, the jet segment fluctuated the most with regard to inventories and pricing. Inventories of late-model jets, those 10 or fewer years old, grew by 2 percent in the first six months of 2016. Late-model jet values were on the decline. Jets older than 10 years tracked by Aircraft Bluebook showed little change in price. Overall, approximately 45 percent of this market segment was in decline.

Turboprop

The turboprop market tracked in Bluebook fared better than the jet market. Of the 662 make-model-year listings, the majority of this market segment remained stable. Again, most of the downward values were attributed to latemodel turboprops while the values of older — aircraft were less impacted. Overall, 62 percent of this segment remained unchanged in value when compared to the previous quarter.

Multi-Engine Piston

The multi-engine piston segment of Bluebook has remained a stable market since the start of 2016. Of the 693 make-model-year listings in the Bluebook, 618 of these models had no price change in this reporting period. Stability is a good thing. Also, limited inventories that are being produced have maintained a better market balance. For example, Beechcraft was reported to have manufactured approximately 18 G58 Barons in 2015 for global consumption.

Single-Engine Piston

Likewise, the single-engine piston market reported in Aircraft Bluebook shadows the multi-engine market. Of the 2723 make-model-year listings reported, there were no changes in 2144 of these models. Again, similarly with other reporting groups, the majority of the few declines were within the late-model groups. A few of the legacy listings had slight increases in value when compared to the previous quarter in Bluebook.

Helicopter

The helicopter segment reported in Bluebook is the most connected to energy markets. Of the 1237 make-model-year listings, 1158 rotorcraft, or about 9 percent of the Bluebook fleet, had no price change when compared to the spring edition of Aircraft Bluebook. It would appear if the energy sectors of the U.S. economy would have a substantial improvement in stability, then business aircraft markets would also follow.

Download the full June 2016 issue of Aircraft Bluebook Marketline.

Announcing the Aircraft Bluebook Market Values Roundtable

Attend the new Aircraft Bluebook Market Values Roundtable to understand the pressure points that affect business aircraft residual values and incorporate the insight into your own forecasts of future values. The event follows the SpeedNews 21st Annual Business & General Aviation Industry Suppliers Conference. Learn more.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |